The supplier credit note is a source document issued by the buyer to the seller for the purchase return journal.

A supplier debit note is a source document issued by the buyer to the seller for excess purchase return journal.

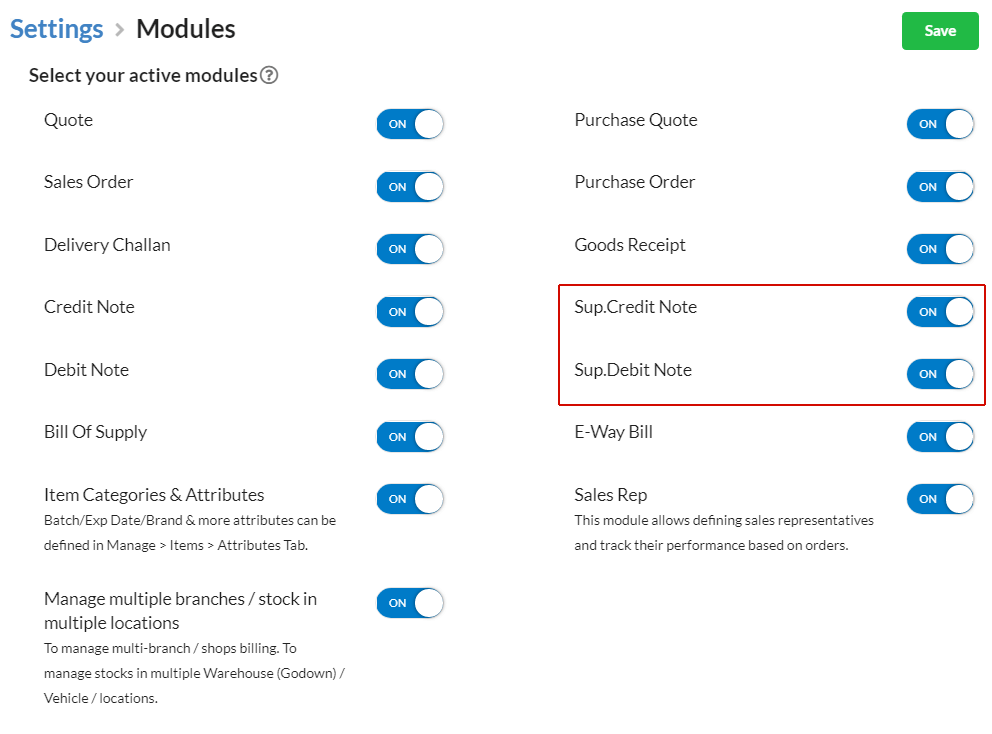

How to enable supplier credit/debit note?

To use supplier credit/debit note in Output Books,

Go to Settings > Modules

Under the option of select your active modules, click the edit option in the top right corner. And now, enable the supplier debit /credit option or both options.

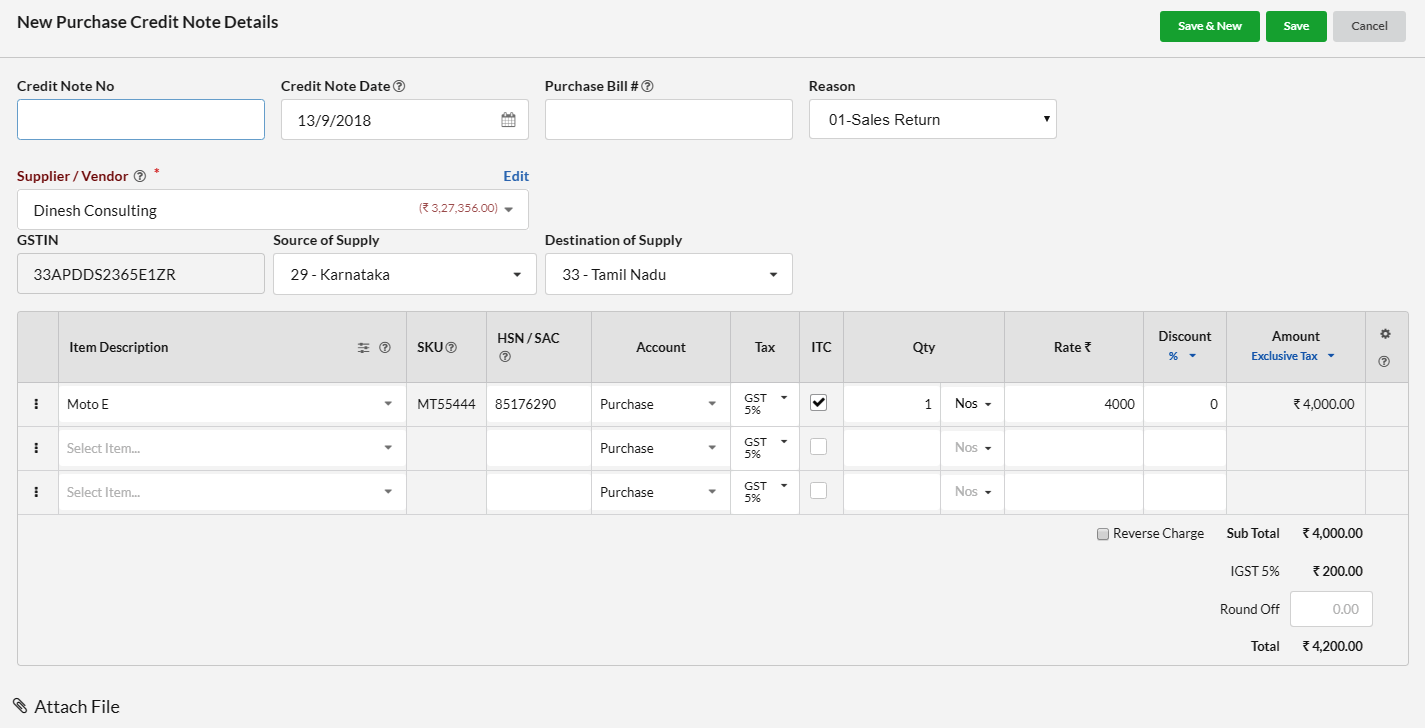

How to create a supplier credit/debit note?

To create a supplier credit/debit note

Click on Purchase in left menu and select Sup. Credit / Debit Note.

Click on the Sup. Credit / Debit Note button and provide the required details.

Hit Save.

| Fields | Description |

|---|---|

| Credit / Debit Note No | The next Credit / Debit Note number will be displayed for your convenience. You can define it Automatic or Manual in Settings > Modules. Credit / Debit Note number should be unique for a financial year. |

Credit / Debit note Date | Date of Credit / Debit Note issued |

Purchase Bill # | Your Purchase Bill number for this Credit / Debit note transaction. |

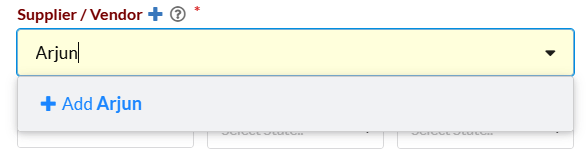

Supplier | Select the Supplier from the drop-down or type in the Supplier name. For New Supplier, enter the New Supplier name & option to Add New Supplier will be displayed in the dropdown. The supplier is the required field for the Purchase order. |

GSTIN | Customer GSTIN will be displayed if already stored or option to enter |

Destination of Supply | Choose State to define Place of supply of goods. Based on this, the Credit / Debit Note will be counted as intrastate (supply within same state) or interstate (supply to other state). For Intrastate both SGST & CGST Tax applied, whereas IGST for Interstate. |

Item Description | Select the Item from the drop-down or type in the Item name or SKU Code. You can also add a new item if not exists in Items Master |

SKU | Stock Keeping Unit-Identification code for the item [Non-editable] |

HSN / SAC | Provide the codes for the Tax classification of the item |

Tax | Select the Tax defined for the item |

Rate | Standard Rate defined in Item Master will be displayed. |

Discount | Discount for Individual Item with the option to provide as a percentage or flat |

Amount | For Exclusive Tax: Display only Taxable Value. Ie. Rate x Qty – Discount. The tax will be calculated for this amount. |

Freight/ Packing / Insurance Charges | You can enable it in Settings > Sales > Sales Charges, for input in Credit / Debit Note. |

| Round Off | Based on Settings > General > Sales Settings > Round off final total amount, Round Off will be calculated. Manual – Need to input needed amount manually Round Normal – to near integer. Ex: 2.50 to 3.00; 2.40 to 2.00 Round Up – to next integer. Ex: 2.10 to 3.00 Round Down – to down integer ignoring decimal. Ex: 2.90 to 2.00 No Round Off – Round off option will not be displayed |

Notes | Notes will be printed in the Credit / Debit Note. You can include additional content or thank you a message to the Customer. Default value can be defined in Settings > Sales |

Terms & Conditions | T & C will be printed in Credit / Debit Note. Default content can be defined in Settings |

Attachment | You can also add attachments related to the transaction |

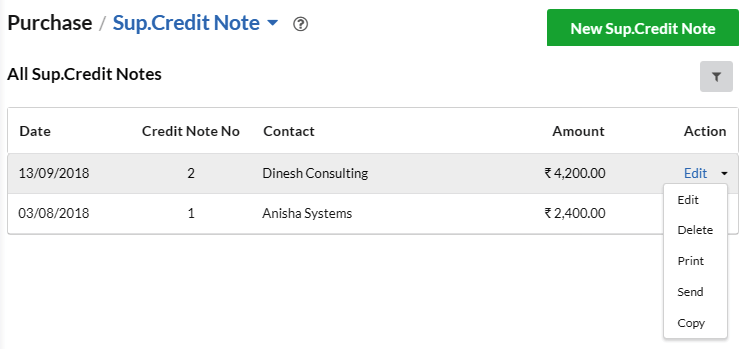

How to edit/delete/send/print/copy supplier credit/debit note?

Click on the drop-down associated with each credit/debit note under Action Category.

And, choose the desired action.