Page Contents

Credit Purchase Bill

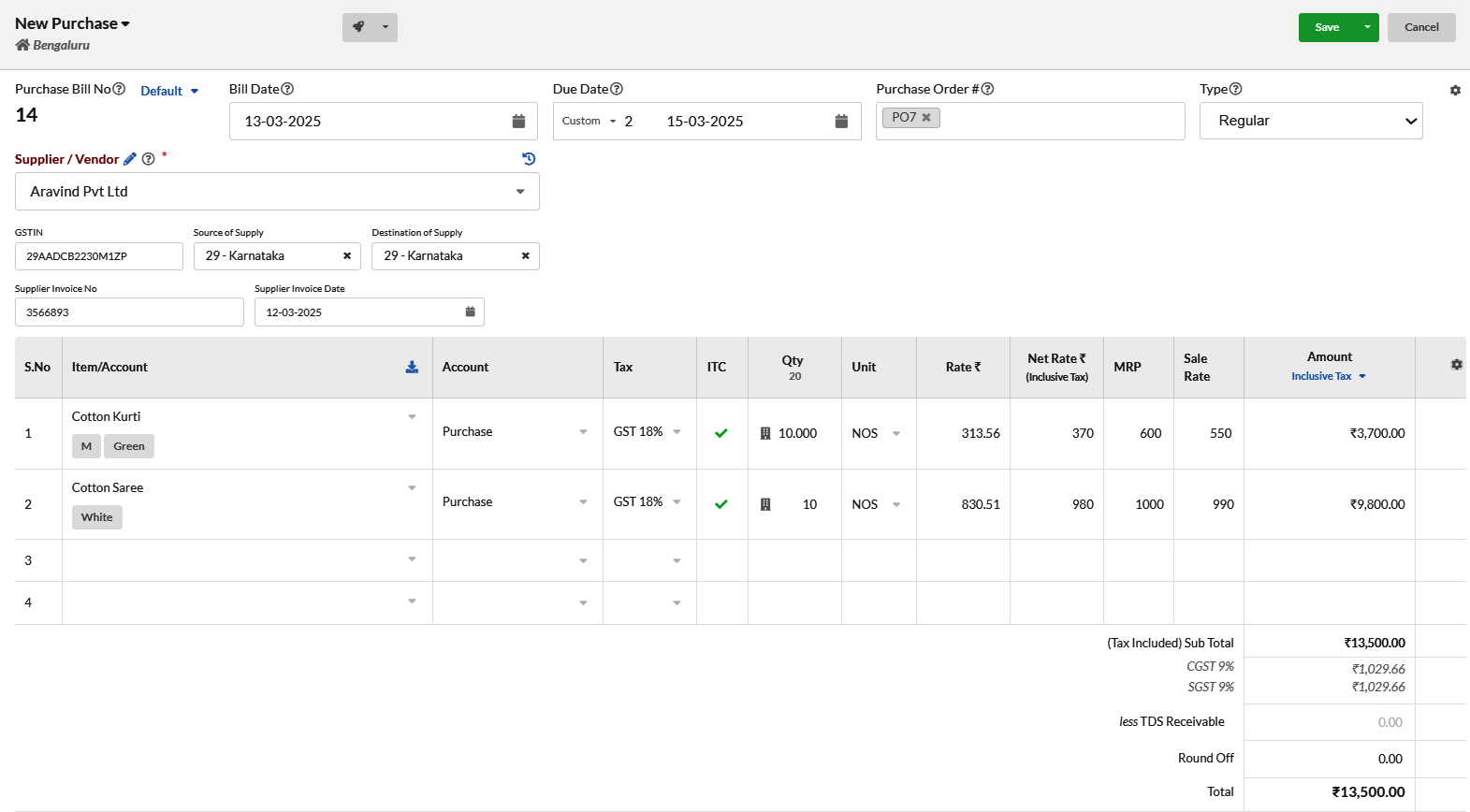

A Credit Purchase Bill is a document that records a transaction in which goods or services are purchased on credit, meaning the payment is deferred to a later date.

- Go to Purchase bill

- Click Purchase in the left menu

- Select Purchase Bill, click New Purchase

- Enter the details, and hit Save.

Manual – Need to input needed amount manually

Manual – Need to input needed amount manually

Round Normal – to near integer. Ex: 2.50 to 3.00; 2.40 to 2.00

Round Up – to next integer. Ex: 2.10 to 3.00

Round Down – to down integer ignoring decimal. Ex: 2.90 to 2.00

No Round Off – Round off option will not be displayed

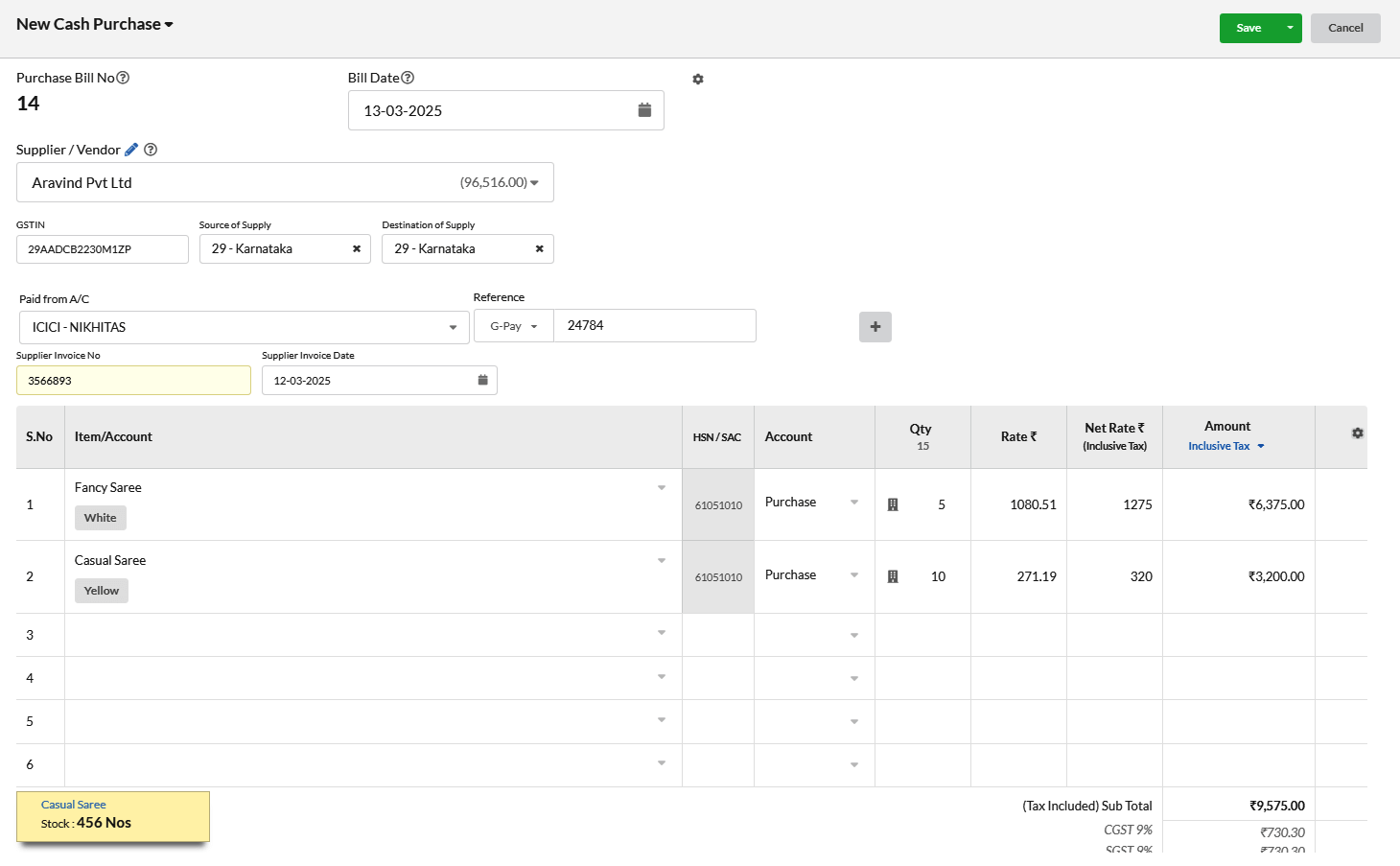

Cash Purchase Bill

A Cash Purchase Bill records a transaction where goods or services are purchased, and payment is made immediately through either cash or electronic transfer (like credit/debit card, bank transfer, etc.).

- Go to Purchase bill

- Click Purchase in the left menu

- Select Purchase Bill, click New Cash Purchase

- Enter the details, and hit Save.

| Fields | Description |

|---|---|

Purchase Bill No | Next number auto-displays, editable, and must be unique for the financial year. |

Purchase Bill Date | Enter the purchase or bill issue date. |

Due Date | Set the payment due date (choose options like 15, 30 days, etc.). |

Purchase order # | Optionally provide the reference; auto-fills if linked to a purchase order. |

| Type | Type of Bills: Regular – Bills provided by supplier, either registered or unregistered. Purchase from SEZ with Tax Payment – Payment of Tax & then collect Refund. Import with Tax Payment – Purchase of goods from another country. Import without Tax Payment(bond/LUT) – The buyer does not immediately pay the taxes or duties due on the imported goods. |

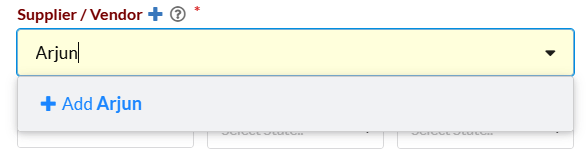

Supplier | Select the supplier from the drop-down or type the name. For a new supplier, enter the name and click “Add New Supplier.” |

Supplier Invoice No | Enter the supplier’s bill number (mandatory). |

Supplier date | Enter the date the supplier generated the bill. |

GSTIN | For existing customers, it auto-displays. For new customers, you can enter it manually. |

Destination of Supply | Select the state to define whether it’s intrastate (same state) or interstate (different state). This affects the tax applied(SGST/CGST or IGST). |

Item Description | Choose or type the item name or SKU. You can add a new item if needed. |

SKU | Non-editable unique identifier for the item. |

HSN / SAC | Tax classification codes for the item. |

Account | Select the account for syncing the purchase bill. |

Tax | Select the applicable tax for the item. |

ITC | Claim Input Tax Credit if eligible under GST. |

Rate | Standard rate from Item Master, but you can update it. |

Discount | Apply discount as a percentage or flat amount. |

Amount | For exclusive tax, it shows taxable value. For inclusive tax, you can edit the final amount, and the rate adjusts automatically. |

Freight/Packing/Insurance Charges | Enable in settings to add extra charges. |

Round Off | Automatically round off the total amount based on settings. |

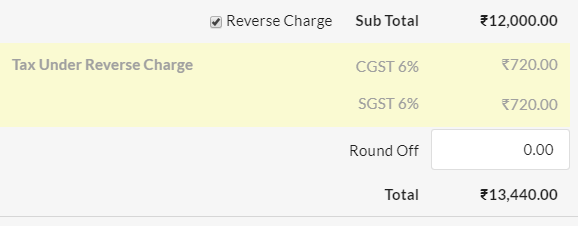

Reverse-charge | Normally, the supplier pays the tax, but in reverse charge, the receiver is responsible for paying the tax. |

Attachment | You can also add attachments related to the transaction. |

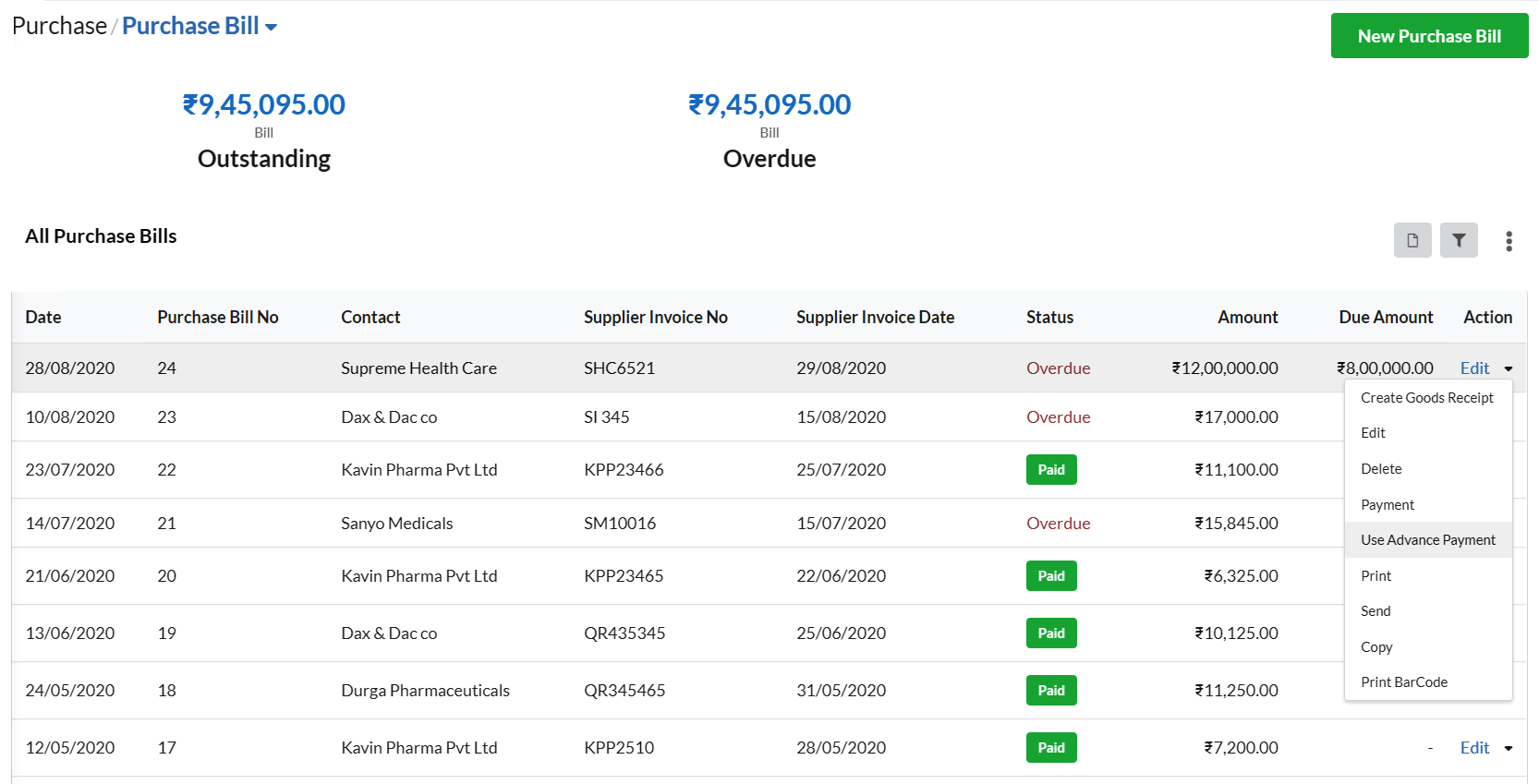

How to edit/delete/print/send/copy purchase bill?

Click on the drop-down associated with each purchase bill under the action category and choose the desired action.

NOTE: If a customer makes the Advance payment, you can use the Advance amount here to pay for Invoice which is under Action.