A Purchase Bill is a printed or written statement of charges.

How to create a Purchase Bill?

To create a Purchase Bill,

- Click on Purchase in left menu and select Purchase Bill.

- Click on the New Purchase Bill button and provide the necessary details.

- Hit Save.

Manual – Need to input needed amount manually

Manual – Need to input needed amount manually

Round Normal – to near integer. Ex: 2.50 to 3.00; 2.40 to 2.00

Round Up – to next integer. Ex: 2.10 to 3.00

Round Down – to down integer ignoring decimal. Ex: 2.90 to 2.00

No Round Off – Round off option will not be displayed

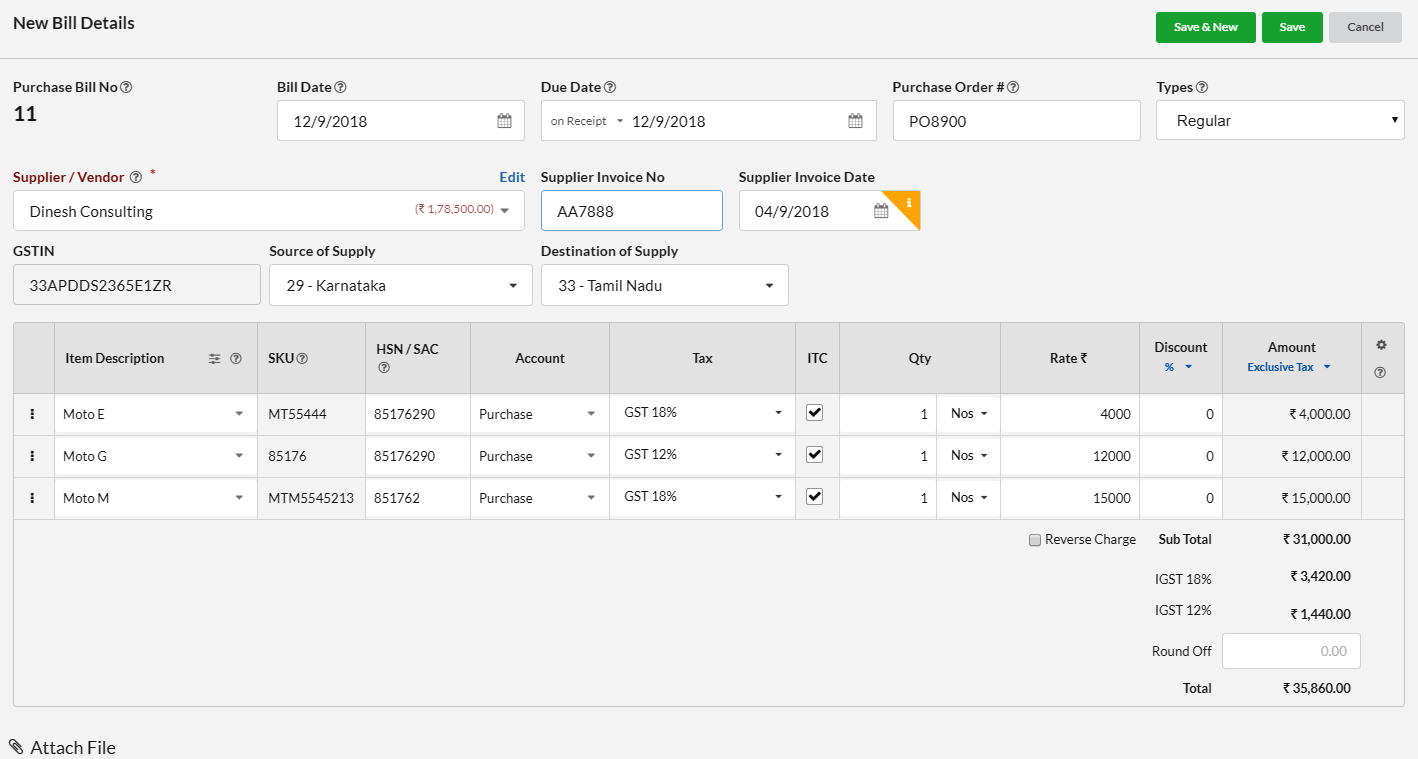

| Fields | Description |

|---|---|

Purchase Bill No | The next Purchase Bill number will be displayed for your convenience, which is editable. You can define it and the number should be unique for a financial year. |

Purchase Bill Date | Provide the Date of Purchase or Bill issued |

Due Date | Purchase Bill should be paid before the Due date provided. You can enter date directly or select option 15 days, 30 days, etc |

Purchase order # | You can provide the purchase order reference for the Purchase bill. If create Bill with purchase order, the reference number is filled automatically. |

| Type | Type of Bills Regular – Bills provided by supplier, either registered or unregistered. Purchase from SEZ with Tax Payment – Payment of Tax & then collect Refund. |

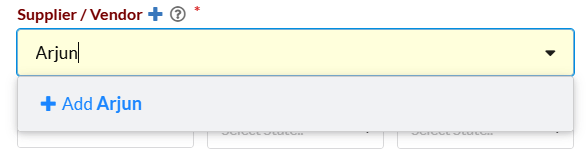

Supplier | Select the Supplier from the drop-down or type in the Supplier name. For New Supplier, enter the New Supplier name & option to Add New Supplier will be displayed in drop-down. Supplier is a required field for Purchase Bill. |

Supplier Invoice No | You can provide the Supplier Bill no for your Reference, which is mandatory. |

Supplier date | Date where the Bill is generated by the supplier. |

GSTIN | For existing customers, it will be displayed on choosing their names. For new customers, you can provide directly. |

Destination of Supply | Choose State to define Place of supply of goods. Based on this, the quote will be counted as intrastate (supply within same state) or interstate (supply to other state). For Intrastate both SGST & CGST Tax applied, whereas IGST for Interstate. |

Item Description | Select the Item from the drop-down or type in the Item Name or SKU Code. You can also add new item if not exists in Items Master |

SKU | Stock Keeping Unit-Identification code for the item [Non-editable] |

HSN / SAC | Codes for Tax classification of the item |

Account | Select the Account to sync Purchase Bill. |

Tax | Select the Tax defined for the item |

ITC | If you are a manufacturer, supplier, agent, e-commerce operator, aggregator or any of the persons mentioned here, registered under GST, You are eligible to claim INPUT CREDIT for tax paid by you on your PURCHASES. |

Rate | Standard Rate defined in Item Master will be displayed. If you have a specific rate you can update in the Rate box. |

Discount | Discount for Individual Item with the option to provide as a percentage or flat |

Amount | For Exclusive Tax: Display only Taxable Value. I.e. Rate x Qty – Discount. The tax will be calculated for this amount. |

Freight/ Packing / Insurance Charges | You can enable it in Settings > Sales > Sales Charges, for input in quote. |

Round Off | Based on Settings > General > Sales Settings > Round off final total amount, Round Off will be calculated. |

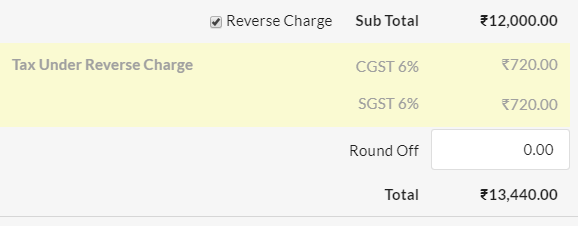

Reverse-charge | Normally, the supplier of goods or services pays the tax on supply. In the case of Reverse Charge, the receiver becomes liable to pay the tax, i.e., the chargeability gets reversed. |

Attachment | You can also add attachments related to the transaction |

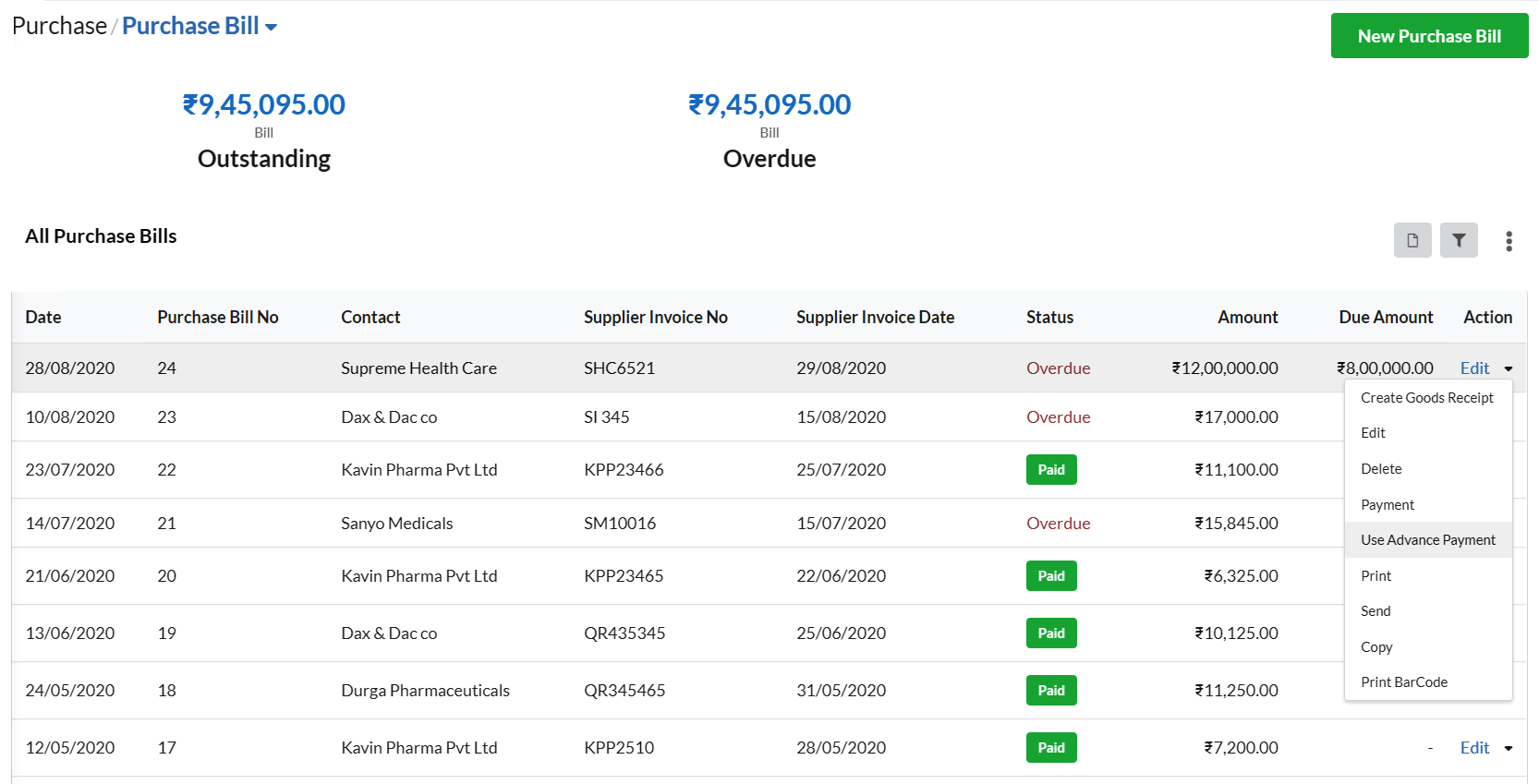

How to edit/delete/print/send/copy purchase bill?

Click on the drop-down associated with each purchase bill under the action category and choose the desired action.

NOTE: If a customer makes the Advance payment, you can use the Advance amount here to pay for Invoice which is under Action.